There are so many reasons that you can consider while choosing the Cash Nest 365 app for your trading. This application has so many benefits for every level of traders. You do not need to worry even if you have no prior knowledge or experience of trading, Cash Nest 365 platform serves everyone according to their needs.

Cash Nest 365 platform is a secure trading application that prioritizes the data protection of its users. For safety, it has used the latest security measures like two-factor authentication. This will not allow any unauthorized person to access your account.

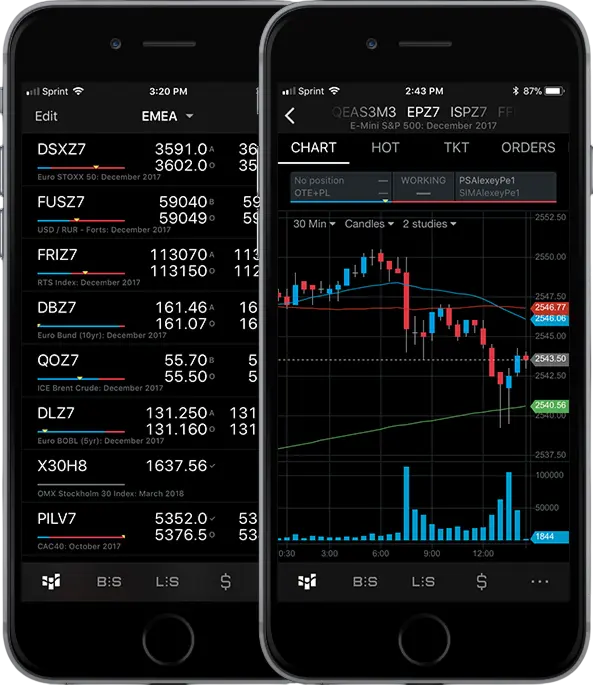

This platform offers the automation of trades and other activities. It saves traders’ time as well as reduces the costs of hiring other traders to watch multiple trades. The financial markets are dynamic and the AI bot makes sure you get the stabilized trades.

The bots are capable of making decisions during the live trades. The bot of the Cash Nest 365 app can decide the next move by analysing market movements and the current situation. It keeps updating the strategies according to the market conditions.

The Cash Nest 365 official website allows non-stop trading for 24 hours. It is able to keep monitoring trades and perform other activities without taking a break. Traders can rely on this platform to trade their favourite currencies and assets.

This platform works on the real-time data of the market. Due to this reason, the insights it provides are accurate and precise. This helps traders make quick and right decisions at the right time. Moreover, traders can make wise strategies using such data.

Enter your name, email, and phone to create your account—takes less than 5 minutes.

Set a strong password to secure your Cash Nest 365 account. Don’t share it.

Deposit at least $250 using your preferred payment method to start trading.

Select AI auto-trading or manual mode. Test strategies with the demo account.

Let the AI trade for you. Watch profits grow and withdraw anytime.

JUMP IN NOW AND CATCH THE MOMENTUM BEFORE IT’S GONE

If you had £100,000 sitting in the bank back then, it would only buy about £80,000 worth of goods today — that’s a 20% loss in real value due to inflation.

Now, while bank savings accounts paid less than 1% interest per year, inflation averaged around 2.5–3%, meaning your money was silently losing value year after year.

But here’s the real kicker — during that same decade, the Nasdaq 100 index grew by almost 400%. In other words, money invested in the market didn’t just hold its value — it multiplied nearly five times.

And while most people trusted their banks to ‘keep their money safe’, the banks and professional traders were using that very same money to make those returns for themselves.

So while your money sleeps, someone else is making it work — for them.

It’s time to take control and make your money work for you instead.